Mortgage and Home Equity Loan Options

Put Your Roots Down

Mortgage Loans

Here for you every step of the way. Get details, view mortgage rates and get expert help along the way.

Browse Mortgage OptionsSolutions as Unique as Your Goals

Home Equity Loans

Find the best home equity option for you and apply online when you’re ready.

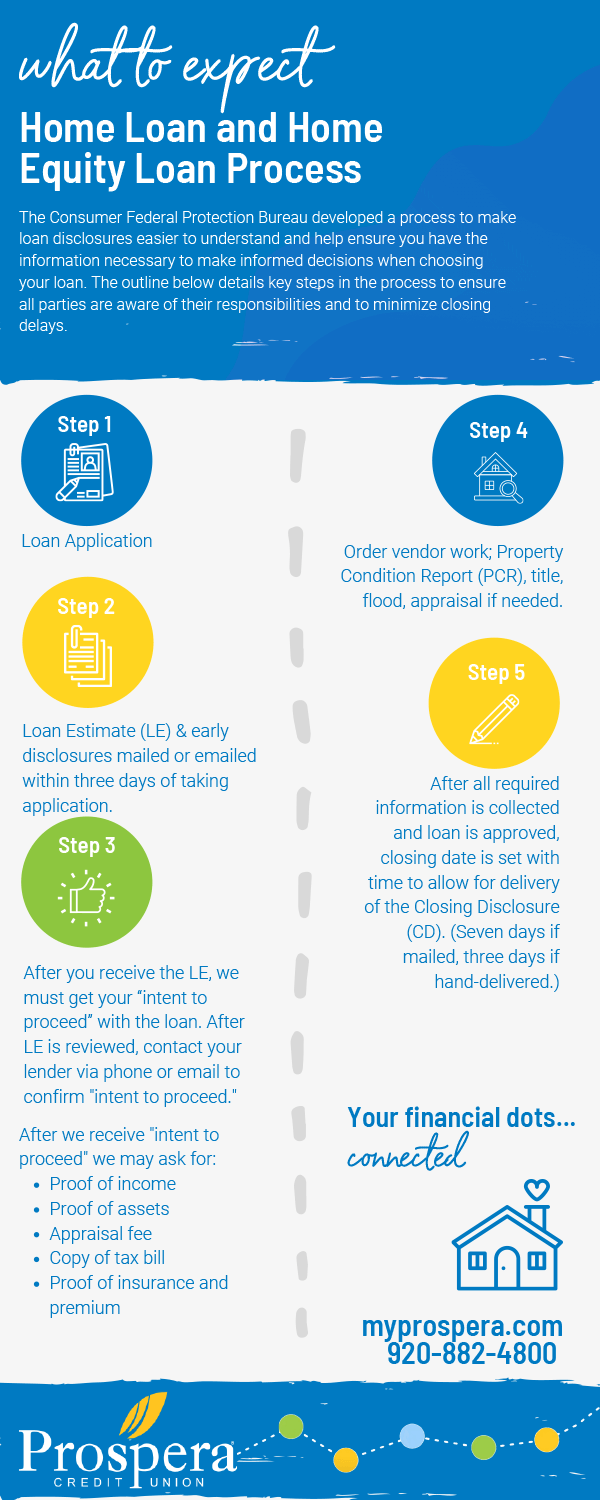

Browse Home Equity OptionsView the key steps in the home loan and equity processes to ensure you stay one step ahead and minimize delays.

Mortgage vs Home Equity Loan

Mortgages and home equity loans are both means of borrowing that require pledging a home as collateral – property the borrower uses as security for the repayment of the loan.

3 Important Differences Between a Mortgage and Home Equity Loan

1) The term mortgage is typically used when a borrower is purchasing a new home.

- A lender usually allows individuals to borrow up to 80% of a home’s value

- E.g. House is appraised at $150,000, the borrower could take a mortgage for $120,000 and would be responsible to pay $30,000, or 20%, as a down payment

- Some mortgages allow borrowers to take a mortgage without a 20% down payment, but then they must also pay monthly mortgage insurance – PMI – Private Mortgage Insurance

- Typical term is 15 or 30 years and the rate can be fixed or variable

- Mortgages can be refinanced at a later date if interest rates have dropped, for a shorter term or to get cash out of their home

2) A borrower takes a home equity loan when they already own or have equity in a property

3) A home equity loan is also technically a mortgage; in many cases considered a second mortgage, unless the home is owned free and clear

- The percentage you can borrow depends on how much of the home you own

- E.g. If an individual owes $150,000 on a home, but the home value is $250,000, the individual has $100,000 in equity, meaning they could take out a home equity loan for $100,000

- Individuals can take out a lump sum (home equity loan) or as a line of credit (HELOC) and then draw on it as needed

Closing costs may vary.